Reboot Investing is an online investment advisor that makes high-quality,

quantitative strategies available to everyone. Answer some questions

online, and let us handle your investing so you can spend your time doing

the things you really love. We love geeking out about quantitative finance

and data science so everyone wins.

We have spent decades developing and running automated, data-driven,

quantitative trading strategies to manage multi-billion dollar portfolios

for large institutions. Over the years, friends and family members asked

us for help managing their money. But, while we were trading for large

institutions, there were burdensome restrictions on our personal trading,

and we were not allowed to offer investing advice to others. We were also

asked to recommend financial advisors, and while we know some who were

trustworthy, the investment management options available on their

platforms were subpar, and expensive. So, even though we believed the

advisors would do their job well, we knew that their hands were tied when

it came to investing strategies and pricing. We built Reboot Investing

because we've wanted a platform like this for a long time and we finally

realized that the only way to get what we wanted was to build it

ourselves.

Modern

Portfolio Theory (MPT), is the Nobel Prize winning investment

theory that most financial advisors tout as cutting edge. What they

don't advertise is that MPT was

published in 1952, when

tic-tac-toe on a 35x16

pixel screen was state of the art. It's time to Reboot your investing

and join us in the new millennium.

We don't look at markets like a typical advisor would. Our goal is to

monetize your ability to take risk for your benefit using whatever

method works best, which may not be just buying assets and hoping the

price goes up. We focus on risk adjusted returns, not absolute returns.

While many investors focus on the explicit fees, it's important

to monitor costs that can be incurred due to conflicts such as

soft-dollar transactions and payment for order flow. We went back to

the drawing board and created our model from scratch to eliminate

conflicts and hidden fees.

We can charge low fees because we are leveraging technology in ways that

no other investment advisor has. There is a single explicit fee, period.

We receive no payment for order-flow, no short-sale rebates, no platform

fees charged to third-parties, absolutely nothing but the explicit fee

you pay us.

Our Story

Reboot Investing was born to fill a void that founder Ashwin Kapur

found when he looked to hire a financial advisor. After an event that

made him face his mortality, Ashwin considered hiring an advisor to

protect his wife and kids’ financial well-being should something happen

to him. He’d spent nearly 20 years developing and running automated

quantitative trading strategies at top Wall Street firms, so he wasn’t

new to the world of investing. After interviewing advisors at an array

of different firms, both large and small, he was not impressed with any

of the advisors, models, technology, or pricing offered.

As part of his research, he studied various robo-advisors. He soon

realized that despite their claims of being innovative, the model the

robo-advisors were using was the same as what traditional advisors had

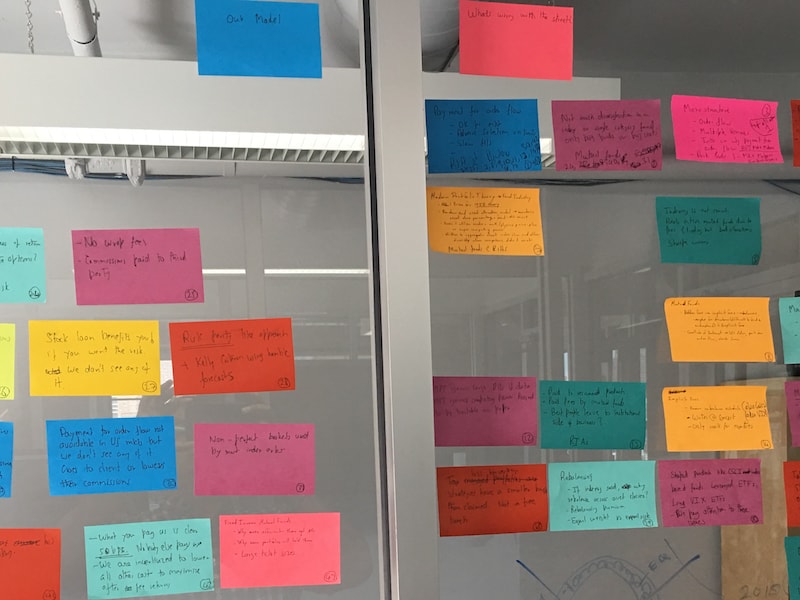

been using for decades. After a series of long geek-out sessions about

how a financial advisor should be structured, strategies that advisors

should use, the details of certain back-tests Ashwin had done etc,

Ashwin decided that the only way to get what he wanted was to build it.

We have scrapped the unrealistic assumptions that advisors have relied

on for the last half century, and built investment models from scratch.

In addition, we are exploiting our in-depth knowledge of how Wall

Street works, as well as techniques used on quantitative trading desks

(but not yet known to academia) for the benefit their clients, as

opposed to banks, brokerages, advisors and other low value-add

toll-takers. Reboot’s strategies are very different from what can be

found at other financial advisors. They are not only designed to

provide good risk-adjusted performance, but to have return profiles

that are compatible with human behavioral biases which reduce the

possibility of performance chasing and panic selling by our clients.

Although Reboot makes every effort to preserve each client’s capital

and achieve real growth of wealth, investing in markets involves risk

of loss that each client should be prepared to bear. All investment

programs have certain risks that are borne by the investor. While

Reboot’s investment approach constantly keeps the risk of loss in mind,

there are no guarantees in the markets.